August 23, 2023

Written By

Trellis Team

Like its cousin, methane (CH4), ammonia (NH3) is a chemical industry staple, a valuable building block, and a fuel.

It is the second most produced chemical by mass, after sulfuric acid, and is known as one of the seven basic chemicals used in the manufacture of all other chemical products.

Ammonia is relatively advantageous as a fuel due to its low cost of storage and transport, especially when compared to green hydrogen. However, its production is also a major contributor to global CO2 emissions.

In this post we examine the role of ammonia in agriculture and transportation, and how renewable natural gas (RNG) and renewable energy can help decarbonize those sectors.

The global agricultural system depends heavily on fertilizers to deliver the crop yields needed to feed a population approaching 8 billion people.

Ammonia is a key building block for all mineral nitrogen fertilizers, creating a bridge between nitrogen in the air and the food we consume.

About 70-80% of global ammonia production goes into making fertilizer and roughly the same percentage of ammonia production comes via natural gas-based steam reforming, following the Haber-Bosch process.

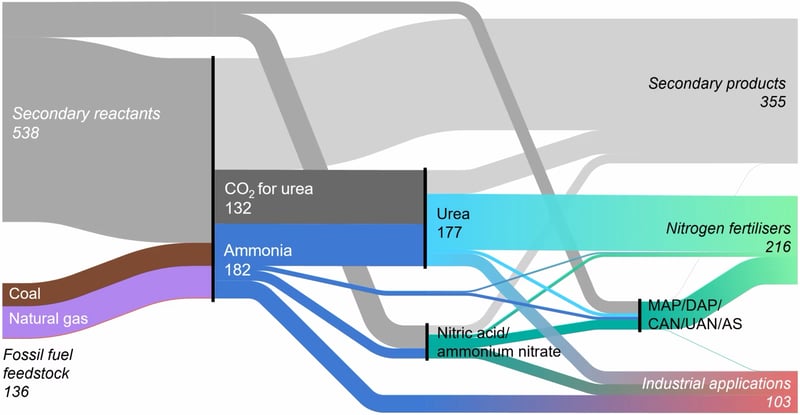

The figure below, published by the International Energy Agency (IAE) illustrates mass flows in the ammonia supply chain:

Source: https://www.iea.org/reports/ammonia-technology-roadmap

Source: https://www.iea.org/reports/ammonia-technology-roadmap

Surprisingly, ammonia production is even more emissions intensive than steel or cement production—frequent targets of emissions reduction advocates.

Direct emissions from global ammonia production are about 450 million tons of CO2 per year.

When divided by the annual ammonia production of about 180 million tons, this yields an emissions intensity of 2.4 tons of CO2 per ton of ammonia.

This is about twice as emissions intensive as raw steel production and four times that of cement.

Ammonia production is forecast to increase by almost 40% by 2050 in response to economic and population growth. In the words of the IEA, this trajectory is unsustainable.

While the agricultural sector works to use ammonia more efficiently, progress is also being made toward lowering the emissions from ammonia production.

This includes developing lower-carbon raw material sources and near-zero-emission production methods.

The most promising pathways include:

Advances are also being made in hydrogen production from natural gas, where autothermal reforming (ATR) is displacing steam-methane reforming (SMR).

In an ATR process, a partial oxidation reaction between oxygen and methane happens within the reformer’s combustion chamber, generating heat for the endothermic steam reforming reactions that happen in a catalytic bed.

This process becomes self-sustaining, removing the need for external, combustion-generated heat that is the source of significant CO2 emissions in a traditional SMR process.

A 2022 report by the International Renewable Energy Agency (IRENA) projected that 80% of new ammonia production could be decarbonized by combining renewable hydrogen and renewable power, with the remainder coming from fossil fuel-based production in combination with CCS.

The first renewable hydrogen supplies have already been retrofitted to existing ammonia plants—accounting for about 8% of current ammonia production—and all new ammonia production capacity added after 2025 is expected to be decarbonized via one of the identified approaches.

The cash cost to develop and operate large-scale ammonia production, including operating renewable energy generating assets, is below USD 100 per ton, which compares favorably with fossil-based ammonia production (especially if CCS is also included).

This cost can be reduced even further by retrofitting fossil-based ammonia plants to introduce renewable hydrogen.

The first fossil-free fertilizers are now being commercialized, and the continued importance of ammonia-based fertilizers to the human food supply means that both increased RNG production and the growth and management of renewable power will be critical to decarbonizing this important sector.

Another pathway to carbon emissions reduction using ammonia is as a zero-carbon fuel in the maritime and power generation sectors.

Ammonia has an energy density similar to that of methanol, significantly greater than cryogenic hydrogen, and requires much less cooling. It can be stored as a liquid at 120psi and ambient pressure, or at -27°F (-33°C) and ambient pressure.

However, ammonia is highly toxic and corrosive, which presents risks to human and aquatic life in the event of an accident and leakage. Including ports and agricultural locations there are over 10,000 ammonia storage sites in the USA alone, requiring significant infrastructure to handle the health and environmental challenges.

The incomplete combustion of ammonia produces nitrogen oxides (NOx) and nitrous oxide (N2O), with the latter being a more potent greenhouse gas than CO2, so the emissions from ammonia-burning engines will need to be carefully managed.

There are also issues to be resolved regarding the bunkering and loading of ammonia fuel, which will require new infrastructure, processes, and skills across the global maritime industry.

The first dedicated ammonia-fueled vessels are still some years away, but commercially available engines are scheduled for delivery in 2024 by MAN Energy Solutions and others.

Power plants based on ammonia combustion (typically in combination with hydrocarbon fuels), ammonia gas turbines, and fuel cells are all being developed.

Wood Mackenzie reports that a 10% ammonia co-firing in global coal plants would provide a quick, low-cost way for countries with large thermal power fleets to lower their carbon emissions, as well as benefiting regions with limited renewable generating and CCS opportunities.

With significant solar and wind energy potential, Australia has been investing heavily in green ammonia studies and pilot projects. For example, the Asian Renewable Energy Hub in Western Australia seeks to produce ammonia for export using both wind and solar energy.

In Japan, a concerted effort to develop a hydrogen-based economy includes using ammonia as a clean fuel for power generation. Several projects are already co-firing ammonia with natural gas and coal in legacy thermal power plants.

The NEOM project in Saudi Arabia promises to include one of the world’s largest green ammonia developments, based on green hydrogen developed using solar and wind energy. Chile and Morocco are also highly competitive sources for renewable ammonia.

And, while progress here has been somewhat slower, interest is slowly building within the U.S., where a growing base of renewable energy generation and a vast agricultural sector make renewable ammonia an attractive opportunity.

Given its importance to the agricultural sector as a precursor to most fertilizers, ammonia demand is expected to rise substantially as the global population continues to grow.

Solar- and wind-powered hydrolysis can be used to produce green hydrogen, which can then be converted into ammonia for transportation to end users.

Ammonia has zero carbon content, offers high energy density, making it practical for storage and transport, and comes with a long history of innovation in its production and handling.

While pure hydrogen has many applications, ammonia offers greater flexibility for transportation, power generation, and industrial use. There is also significant global infrastructure already in place to make, move, store, and deploy ammonia.

There is therefore a robust business case for investment in RNG, renewable power, and renewable ammonia projects as part of the enterprise-scale net-zero toolkit.

Tags: Natural Gas , Energy Transition

As we wrap up the year and prepare to catch our breath over the holidays, it’s time to review the year’s highlights. From new customers to new features, it’s been a productive twelve months! We’re...

As a company that specializes in the management of natural gas trades and transactions, we’re fascinated by the molecule that makes up 70-90 percent of natural gas: methane. Larger, more complex...

© 2023-2026 Trellis Energy Software, Inc. | Terms of Use | Privacy Policy | Mailing Address